Bringing you weekly the latest updates in China Sourcing, so you can stay on top of the game and better prepare for the ongoing Supply Chain challenges. Stay tuned!

Update 06/17/22

US Import Volume from China “Drop off a Cliff”

- US Import demand dropping dramatically 36% YOY… Why?

- Inventory glut – excess inventory

- Inflation crunching US consumer purchasing

- Container volumes from CN to US continue to decline

Image Credits: FreightWaves

According to FreightWaves, Inc, U.S import demand is dropping dramatically by 36% year on year from June 2022 from 2021 to 2022. This decrease happens due to some leading causes; the first is inventory collide. These retailers have excess inventory. Second, consumers are getting crunched due to inflation. Thirdly, this is causing container volumes from China to drop as well.

So, you see fewer imports into the U.S. The good thing is that this is benefiting the shipping price and that the shipping prices are starting to go down; the Freightos index is around $9,000 per container. However, this may be a sign that the economy is slowing down.

Update 06/03/22

China Sourcing Updates

As of Wed. June 1st, 2022 Shanghai has lifted the COVID lockdown according to Reuters.

Source: Reuters/Aly Song

While the people are starting to resume a normal life and offices are now open, in terms of the supply chain it can be best summed up as “Everything is happening at once” according to Jarrod Ward, a supply chain executive from Yusen Logistics based in Shanghai.

Further reports from supply chain professionals say that “I think the best way to describe it is that the firehose has been turned on full but the water is being forced through a sieve. There’s massive back pressure and splatter as everyone is trying to figure out how to make things work while complying with the new reg(ulations).”

Takeaway: While this is great news it may be a bumpy ride ahead in the near future as the supply chain tries to get back on track.

The Sourcing Shift Away from China?

As of mid-2022 China is no longer the only sourcing game in town.

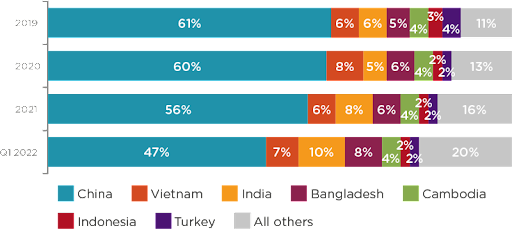

We have seen a shift away from China in the last 3 years as other sourcing destinations are gaining the share of the sourcing market.

According to a survey of US and European businesses by QIMA, the top sourcing destination has shifted away from China. In 2019 China represented 61% but it fell by 14% to 47% in Q1 2022.

Similarly India’s sourcing market share has risen dramatically from 6% to 10% in the past 3 years.

The takeaway is we are seeing a shift in the sourcing and supply chain base towards countries like India and Vietnam.

Another key trend is “Nearshoring” as buyers are shifting their sourcing to nearby destinations such as Mexico for US buyers and Europe for buyers in the EU. The thinking is that this close proximity will reduce shipping costs, lead times, and lower duties and tariffs.

A key point to consider is that while buyers are shifting sourcing, they are not completely moving out of China because China is “too big to ignore”.

No other single country can replace China. In fact the big players such as Apple and Nike have been adopting a China +n strategy. They are outsourcing some products into other countries while keeping the non-movable production in China. They have been doing this China +n for years. Shouldn’t you?

Good news – you probably don’t have a sourcing or supply chain department in your business so I’ve done the work for you.

Update 05/27/22

What we know:

- Port congestion in Shanghai could lead to airfreight congestion

- Shanghai aims to lower down restrictions on June 1

- Beijing authorities are strictly monitoring business ad residents

Image credits: Pexels

According to South China Morning Post, Shanghai aims to lower down restrictions on June 1. However, the production backlogs could lead to airfreight congestion in the coming weeks as they decide to loosen the pandemic restrictions. Despite this, the vast majority of shops, restaurants, and enterprises remain closed, and a work-from-home policy remains in effect.

Beijing on the other hand is still the Covid-19 hit capital of the country. As a result, they continue to tighten their zero-CoVid approach imposing consequences and punishments on businesses and residents that will not follow the mandate, Rappler Asia Pacific reported on Wednesday.

Despite the damage it has caused to the world’s second-largest economy and global supply networks, the government continues to focus on the zero-COVID policy. After a series of incidents involving a private logistics company within its control, certain employees of the state-run Beijing postal service were either fired or given a strong warning.

A few employees at a Beijing branch of the state railway corporation disguised their trip history and have been placed under police investigation.

According to the Shanghai local statistics bureau, exports from Shanghai, the world’s biggest container port, tumbled 44% year on year last month, while imports fell 33%, the steepest decrease since at least 2011.

Update 05/20/22

China Sourcing Updates

What we know

- Shanghai continues to be in lockdowns for over 6 weeks now

- Tesla nearly stops production at its Shanghai plant due to lack of component supplies A lot of companies experience plunging sales this Q1

- We are unsure when China can lift the lockdowns

As Shanghai enters its 6th week of lockdowns with no end in sight, the impact on the supply chain has already reached the global scale. Companies all over the world have felt the disruption.

Automakers, fashion houses, breweries, tech firms, and other 180 companies considered China’s lockdowns key variables affecting their Q1 earnings.

In fact even Tesla has been forced to slowed production nearly to a stop at its Shanghai plant this week because of lack of subcomponent availability due to the Covid lockdowns according to a Reuters report.

We will keep our eye on this as the uncertainty continues.

Update 05/13/22

China Sourcing Updates

What we know

- China disruption continues to hurt the international supply chain

- International companies are having hard time restarting operations

- It is difficult to predict when will this dilemma come to end

As a world manufacturer, China’s disruptions are impacting the global economy and adding another danger to the inflation picture. The government attempts to restore production in Shanghai, where most of the populace has been under lockdown for five weeks.

However, many international companies claim they are still unable to begin operations. China’s inflation report will be scrutinized as food and other product shortages, exacerbated by lockdowns, drive up prices. Consumer price rise is expected to go up, but factory-gate inflation is expected to stay high.

On the global scale, businesses like Tesla Inc. and Apple Inc. are still experiencing disruptions in their supply chain. “Global port congestion is intensifying and spreading, according to RBC’s Head of Digital Intelligence Strategy, Michael Tran, and colleague, Jack Evans, admitting it was difficult to predict when things would ease.

Takeaway:

As Amazon sellers, we must be aware that some macro concerns like this may impact our companies. During these times, we must be hands-on with our business. We can only plan, plot, and design strategies to decrease the impact because we are the ones who are experiencing it.

Image Credits: Pixabay

Update 05/06/22

China Sourcing Update 5/06/22

What we know

- There are no recent changes in policies and rules implemented in China.

- Shanghai is still on lockdown, and our sources on the ground estimate that this will go on for another 2 months.

- Beijing is also under restrictions, and many areas are strictly monitored to prevent worsening the Covid situation.

- The Covid lockdown in China is still affecting logistics, deliveries, and trucking, and nothing has improved yet.

According to Fitch Ratings, near-term profitability constraints are developing for Chinese enterprises in various industries. Domestic and international consumer demand is being hampered, while a slew of travel restrictions is hindering supply chains inside China to halt the spread of Covid-19 cases.

Given weakening consumer confidence and the impact of lockdowns, China’s retail sales growth is expected to slow to the mid-single digits in 2022. Tourism, leisure, and luxury items, which benefit from discretionary expenditure, are expected to underperform basics.

This may put downward pressure on the ratings of more liable companies in these discretionary industries. Furthermore, gentler consumer demand in developed markets will increase demand pressures for Chinese corporations. This event is due to tighter monetary policy, normalization of demand patterns following the pandemic’s increase in goods purchases, and high inflation.

Image Credits: zhang kaiyv from Pexels

Update 4/29/22

China Sourcing Update 4/29/22

What we know

- Manufacturing and export hubs in China is on the verge of halting their operations

- The Covid lockdown in China is pushing the logistics chaos

- Region to region entrance requirements are negatively affecting truckers

Image Credits: iStock

As we have shared in the past weeks, Shanghai is the hotspot of China’s current Covid-19 outbreak. Because of this, nearby regions like Wenzhou impose strict entrance policies.

Truck drivers are required to show several health declaration forms to prove that they are Covid-free. It is also essential that they have not been in virus hot spots in the past two weeks. On-site Covid tests are also required.

However, even though drivers meet all the criteria, authorities are still eager to isolate them for a minimum of two weeks within the quarantine center. Passing all the requirements is perceived as useless as some local officials would still push the isolation. As a result, these decisions hampered the transport of foods.

As the lockdown continues its fourth week, the logistic services become non-operational, especially in the Yangtze River Delta. Manufactured goods are piling up in warehouses due to trucking delays. Manufacturers also expect to pause their operations as they, too, experience delays in receiving raw materials.

Despite all these, some people suspect that lockdowns may be lifted in the first week of May. Trucking and shipping companies will then cope with their backlogs and lulls in production. Kentaro Yoshida, general manager of Yasuda Logistics, said it would be in July that international logistics return to its regular operation. “The current scenario at the Shanghai port is like rubbing salt into the wound,” he continued, referring to Shanghai’s troubles as atop already crippled international logistics systems and supply networks.

Update 4/22/22

China Sourcing Update 4/22/22

What we know

- There is a mass marine congestion on the east coast of Shanghai amid COVID lockdowns

- Experts are warning us for the next global shockwave of China’s harsh lockdowns

- Chinese lockdowns are starting to hurt the American and European supply chains

- The lockdown status is almost the same as last week

Image credits: MarineTraffic

Amid the city’s COVID lockdown and worries about its financial and social impact, Marine Traffic photographs reveal massive sea congestion off the east coast of Shanghai and surrounding its port.

We received information stating the river system is still operational for those cities nearby, such as the Long River. You can still move your shipment through a riverboat to the Shanghai seaport. However, not everyone knows about this information since not all shipping companies offer this service.

Another partner in China shared that the lockdown updates were as similar as last week. However, they expect all operations to go back to normal on the 1st of May.

As Shanghai was still locked down, Ningbo suffered a lot of pressure for shipping. Many cities are semi-closed or only allow local people in, especially in Beijing and surrounding cities. Everything works fine, except for trucking to the port warehouse, which suffered a lot.

Yiwu, a city in the Zhejiang Province, is okay. There are very sporadic pockets of lockdowns in small towns. There are temporary lockdowns, usually for one to two weeks affecting the manufacturers located in the said cities.

If a COVID case happens in these small cities, that specific area would immediately be locked down, but it is very irregular. Nobody knows when and where the subsequent lockdown occurred.

We are seeing delays in FedEx and shipping out of China in air shipping. Some airports are affected, such as the Shanghai Pudong International Airport. So, they may need to route packages to distant airports, which would cause additional delays. Check with FedEx if you are shipping by air.

We are seeing delays in FedEx and shipping out of China in air shipping. Some airports are affected, such as the Shanghai Pudong International Airport. So, they may need to route packages to distant airports, which would cause additional delays. Check with FedEx if you are shipping by air.

Update 4/15/22

China Sourcing Update – Friday, April 15, 2022

What we know

- Shanghai is still under lockdown and nobody knows when things will get back to normal

- Though the Shanghai Port and Terminals are open, trucking products to and from the port is a big problem

- Other regions of China such as Shandong are opening up but still feeling the effects of lockdown

Rumor: Ningbo and Suzhou are pretty close to a full lockdown

As of April 15, Shanghai and its 30 million residents are still under lockdown with no end in sight.

Anecdotally speaking, my friends and family in Shanghai have been having problems getting enough food since the lockdown began. Not only can they not go outside, even food delivery services have been suspended.

The Ports in Shanghai are open and operational but the problem is getting the trucks to the ports. There have been many road closures and Covid PCR test points which are causing delays and even quarantines when drivers test positive. A number of drivers are refusing even to accept deliveries when they need to cross through multiple regions and checkpoints so they don’t risk going into quarantine.

All this means that the supply chain is under a lot of stress and facing disruption in many parts of China.

A total of 193 expressway exits and service areas have been shuttered in Jiangsu and Zhejiang provinces. As a result, the country’s delivery network from electronic to raw materials has slowed down.

I have even heard rumors that Ningbo and Suzhou are going under lockdown soon due to a rise in Covid cases.

In Shandong province, factories have been reopening which is good news, but on the other hand the bad news is the supply chain is not operating as normal. For example, domestic shipping options have been severely restricted due to the COVID lock downs. In one instance we tried sending samples from our supplier in Weifang, Shandong, to our partner in Zhejiang province. However, the courier simply couldn’t take up the samples at all so we were stuck and we couldn’t send the samples out.

So on the surface, even though lockdowns may be lifted, in reality there are still many weak links in the supply chain that you need to watch out for. I recommend that you communicate with your contacts on the ground in China to get real world information and to minimize disruptions as much as possible. All in all I would add an additional buffer in the delivery lead time of 50% longer than expected and to plan your orders accordingly.

Update 4/8/22

China Sourcing Updates – Thursday, April 8th, 2022

Image Credits: Saunak Shah from Pexels

While some parts of China are returning to standards, like Shenzhen and Shandong province, Shanghai is still experiencing a severe sustained lockdown. There are mixed reports on whether Shanghai ports and logistics are operating as usual.

The status is changing day by day, if not hour by hour. My main recommendation is to work with your suppliers and freight forwarders to get the latest information on how to minimize the disruption.

In terms of civilian life in Shanghai, many families are stuck at home. Going out to walk their dogs in their apartment complexes seems impossible. Meat and seafood are in short supply. So, it is a very chaotic time. As to when the lockdown in Shanghai will end, nobody knows for sure. Some people suspect that it may last until the end of the month.

Trucks are still able to enter Shanghai despite the lockdown. However, several local governments in other places refused to allow Shanghai truck drivers to pick up products. A shift to FOB Ningbo, 250 kilometers from Shanghai, might be preferable.

Takeaway:

Amazon sellers should strategically plan on their restocking and inventory to avoid taking a loss due to delays.To avoid interruptions caused by the pandemic, continue monitoring and engaging with your suppliers.

Update 4/1/22

China Sourcing Update 2022: What’s new and what’s changed? – April 1, 2022

I have just finished giving an informative and valuable live session at this year’s SellerFest hosted by OrangeKlik. In my live session, I talked about the latest updates in 2022 China Sourcing, delays, Which parts of China are affected by COVID lockdowns, Shipping costs update, and what can you do to reduce the impact of sourcing challenges.

In this valuable session you will learn:

- What sort of delays can be expected?

- Which parts of China are affected by COVID lockdowns?

- Shipping costs update – prices coming down?

- What can sellers do to reduce the impact?

Check out the replay of my live session here to know the latest updates of Sourcing in China and how to overcome disruptions in the supply chain in 2022.

Update 3/25/22

China Sourcing Updates – March 25th, 2022

According to our sources on the ground, Shenzhen is no longer in lockdown and factories and deliveries are beginning to resume as normal.

However, other parts of China continue to be affected including the Shandong area. One of the suppliers I’m personally working with has experienced a lockdown until Monday March 28th, at the least.

So, the takeaway is continue to monitor and communicate with your suppliers to minimize the disruptions due to the pandemic.

Update 3/18/22

Covid shutting down China factories and ports – things changing by the hour – March 18, 2022

China which has a zero tolerance policy towards Covid this week has locked down several key cities including Shenzhen which is a major manufacturing and electronics hub.

This is important for Ecommerce sellers because many many factories are being affected in and around these areas.

I spoke to 8 Figure Seller Chris Davey who lived in Shenzhen and he shared that the things in Shenzhen are changing by the day if not by the hour.

“What we can be good today, will be bad tomorrow.”

According to Chris, All factories in Shenzhen are shut down except Foxconn. They have a closed loop where employees are not allowed any outside contact away from the work facilities

The nearby Port of Yantian (major port of Shenzhen, Dongguan, and surrounding provinces) had been shut down for several days. It was just announced within the last 24 hours that it has been reopened and workers are now allowed to resume loading containers.

In terms of the city of Shenzhen itself, as of March 18, 2022, 5 districts have been allowed to open up while the remaining districts are closed. These 5 districts have allegedly had no cases.

However parts of the major highways are fenced off around the closed areas. This will make moving products very tricky to get from factories to the ports.

Another key consideration from the sourcing side is even if your factory is open for business, if one of your products subcomponent’s factories is shut down, then your whole production may be stopped.

In other words your supply chain is only as strong as your weakest link and if any of those links (raw materials, subcomponents, trucking, port and container loading) then your deliveries will be affected.

What is Chris’ advice to sellers looking to minimize the disruption?

He recommends “Keep in touch with your supplier to find out what’s going on with them.”

In terms of logistics, “even though the container port may be open – getting the container there may be tricky!”